The Fed is a False God

Do not worship a federal institution. Extraordinary claims require extraordinary evidence.

“Don’t fight the Fed” is both asinine and completely correct.

It’s asinine because the Fed is not responsible for the direction of the economy, inflation, and growth (to claim you control interest rates is one in the same as taking responsibility for these things). Imagine Soviet Russia asserting they control the economy with buttons…. a self-evidently absurd government fantasy. Well, the US rebranded these optics very effectively.

However, the statement is completely correct when you understand “Fed” is simply a sorely misguided proxy for “the direction of the economy and interest rates”. Yes, you absolutely should not fight this.

Here’s a rewrite that removes the pseudo-worship of a government institution, a false god, and distills it down to what that phrase is actually trying to communicate:

“Don’t fight the prevailing growth and direction of the economy.”

Much better. And true!

The Fed Tags Along: A Follower, Never a Leader

There was a horrible jobs print recently and reports of recessionary activity. As a result, there’s chatter that the Fed is going to “lower” rates.

Except, well, there’s a problem: rates have already been going down. In fact, they’ve been sideways-to-down the last couple years while the Fed has been holding flamboyant press conferences telling you it’s been “raising” them. What’s the opposite of “speak softly and carry a big stick”?

Here’s the yield curve from Dec '23, taken from my essay The Fed, Part 6: Interest Rates & Futures For Dollars (read the linked essays after you finish this one).

This yield curve said quite clearly that demand for money in the future is declining, meaning growth is declining. Meaning a recession is on its way. Which means yields go down. On their own.

A noble society would recognize economic activity is why interest rates have been heading lower. The yield curve has been saying this for years, heavily inverted, and now it's happening. Rates were headed lower all on their own, yet we allocate mental energy worshiping a government institution who claims to control the uncontrollable. This is their decision, you see!

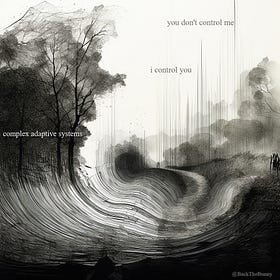

To understand the yield curve was communicating this, you need to internalize that the term structure of rates is the economy communicating something to you, not a government institution. Interest rates are an OUTPUT from a complex adaptive system, not an INPUT from a panel of bureaucrats. Just as governments don’t control the weather (even if their models assure you otherwise), governments don’t control massive economies and resource allocation. Because man and his agencies do not control complex adaptive systems of consequence. And even if they influence them, it’s never how they expect.

The surest sign of a midcurved institution is its insistence on an ability to control, predict, and dictate to complex adaptive systems. You don’t control them, they control you.

Interest rates and the yield curve are best understood as futures for dollars; meaning they’re a forward-looking market for credit demand. You need credit to create growth, low credit demand means low growth, high credit demand means high growth.

Interest rates are the price of money at certain points in the future. Banks sell money to buyers, and you buy money if you can invest it productively. If banks are raising the price of money, that means the demand for it is high, which means growth is. If they lower the price of money, the inverse is true.

Here are excerpts from The Fed Part 6 that elaborate:

Envision interest rates as futures for dollars.

Just as there isn’t one price for wheat, oil, corn, etc., but prices for them at points in the future (what futures and their month of expiration are), the price and demand for dollars can be conceptualized the same way with the yield curve and interest rates: futures for dollars.

Credit creation, which is responsible for money creation, is not permanent. Dollars have a temporal nature to them. Banks issue loans, birthing new dollars in the process. Those dollars will die when debts are repaid. Money has a lifecycle.

Low interest rates are commonly associated with easy money. This is bad framing. What low rates tell you is growth and inflation are low. Because rates are undeniably a composite of these two inputs. If rates are low, it means inflation and/or growth are low; if they’re high, it means one or both of these things are high. Just add them up, that’s what interest rates are.

Money created via debt has an expiration date. Credit births new dollars.

When loans are repaid, those dollars die.

An inverted curve means not enough dollars will be born to offset the deaths.

A contraction of the money supply produces a contraction of the economy.

Reviewing Rates from 2020 - 2024

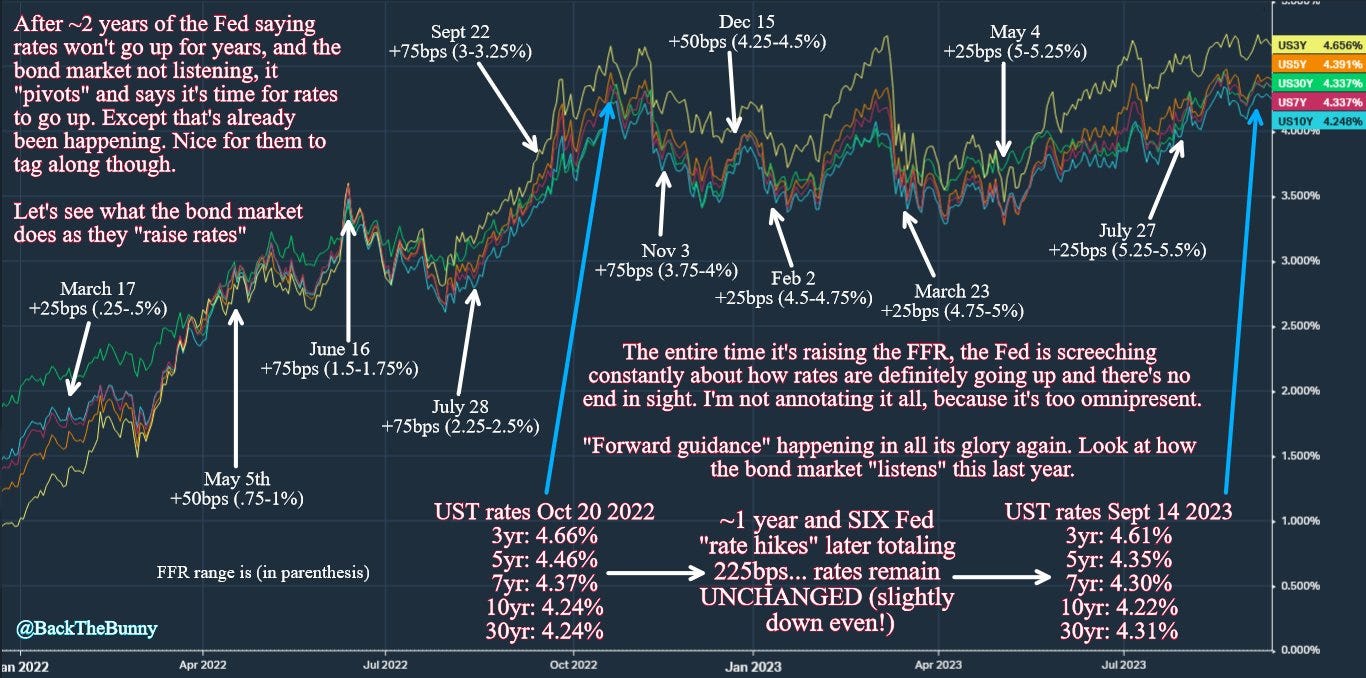

Rates have refused to budge since Oct 2022, all while the Fed "hiked" them, constantly squealing at you how it was raising them:

This is a continuation of what we saw in 2020. Interest rates behaved completely independently of the Fed, persistently going up while being told "don't go up" (the annotations on this chart are very real, I went back and looked them up). They don't budge while they're "raised", and they go up while being “lowered”…. curious!

Is this what control looks like to you?

The two previous charts are from The Fed, Part 5: Forward Guidance, Complex Adaptive Systems, and Interest Rates. If your rejoinder to this is something along the lines of “forward guidance”, please read The Fed Part 5 after you finish this, and then don’t use that term ever again.

Monetary Witchcraft and Raindances

In addition to the bad employment data, we also learned a million jobs were faked. So, a recession? The recession the yield curve said was coming looks like it’s en route (the curve has been inverted since well before Dec 2023). Interesting.

So now the government institution, who over these last 4 years said rates were going to stay down as they went up, and then said they would go up as they went down, is telling you it’s now going to "lower" the rates THAT HAVE ALREADY TOLD YOU FOR WELL OVER A YEAR THEY'RE HEADING LOWER AND HAVE FALLEN ON THEIR OWN.

This is economic dark-ages thinking. Monetary witchcraft. You are watching a rain dance, and then thanking Vishnu for the thunderstorm that was already on its way.

You must begin to see through this disgraceful charade. Go back and look at those charts and reflect on the behavior of interest rates relative to the entity that “controls” them.

A society that appreciates emergent phenomena, Chesterton's Fences, and that 4th-order effects are not something their simple lizard brains can foresee, would understand that concrete, real changes in economic activity inform the cost of money; which is what interest rates are. When economic activity declines, growth declines, thus rates decline.

This is why no one can predict rates, not even the Fed, because no one dictates them, because no one can predict Nth-order outputs from a $27 trillion complex adaptive system.

Standards of Evidence

If anyone else told you they controlled something that so obviously didn’t obey them, would you accept their claim? If your answer to that is “no”, then why do you make an exception for the Federal Reserve? Why does it get a carve out and an absence of a standard of evidence you’d apply anywhere else?

You lower your standard of evidence on anything related to this contemptible government institution without even being aware of it.

From The Fed, Part 4: The Federal Reserve Does Not Control Interest Rates:

You don't prove a negative (a claim you can't do something), you prove a positive (a claim you can do something). Yet here I am, proving a negative. You understand the government lies and manipulates about its abilities almost constantly, but not here though. No, when it comes to monetary policy the Wizard of Oz is honest about its control.

Don’t let “dude, trust me” work when a government institution wants you to believe it’s omnipotent. Ask questions, get specific! A religious, mythic mystique seduces you into abandoning an evidentiary standard. You have strong opinions about what the Fed should do, but you have zero questions about whether it can do those things in the first place. Do not simp for a government institution. Demand proof when it has a very obvious motivation for deception. Don’t trust, verify.

I’m not asking you to agree with me, I’m imploring you to examine extraordinary claims critically. My claims are NOT extraordinary, THEIRS are. You have been psyoped into believing otherwise.

Thought Experiment

Pretend no one has told you anything about rates or central banks. Your finance professor didn’t give you a book that told you what to think. The TV hasn’t duly assured you that the government controls the market with buttons. After looking at the above charts, look at this one.

Like a baby lamb just learning to walk and navigate the world for the first time, who has to take each step based on praxis and the reality of his surroundings, and not academic Lamb Step Critical Theory on how walking ought to work, tell me what you see:

If you’d like to get technical and go over the exact mechanics of how the Fed does the things it claims with interest rates, you can read The Fed, Part 4: The Federal Reserve Does Not Control Interest Rates. This chart is from there.

Do you think a government institution controls the growth and inflation of a $27 trillion economy with buttons and press conferences? Because that’s what you must believe to think they’re controlling interest rates; because interest rates are incontrovertibly a composite of these two things.

The True Brilliance (Deception) of Volcker

The interest-rate control origin story can be found in the lore of Volcker. Volcker's accomplishment isn't doing anything to inflation, it's the psychological victory he pulled off convincing everyone the Fed was responsible for any of it.

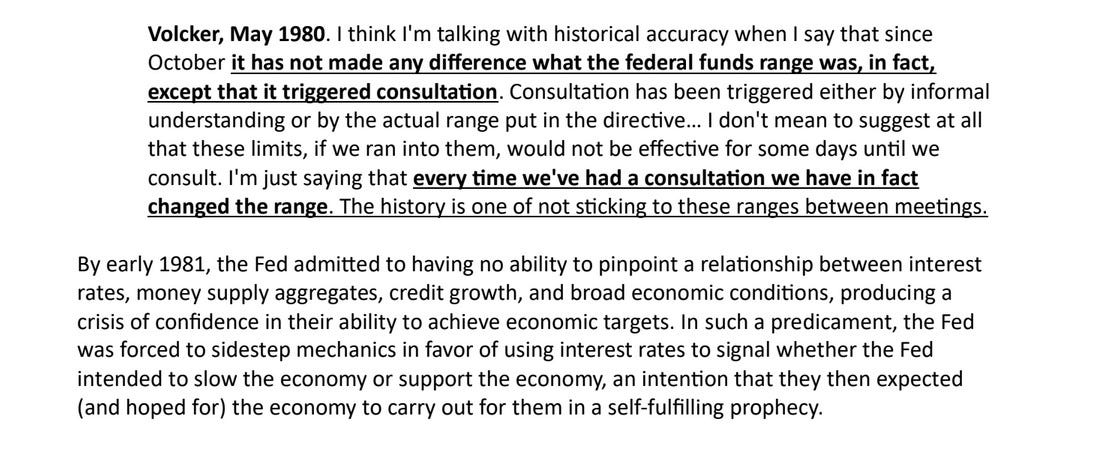

FOMC conversations from 1980-81 candidly speak to it. They admit they’re lost when it comes to money creation and reserves. And since they have no idea how to control money, and they don’t really focus on the Fed Funds Rate, hey, why not emphasize it more:

How much more clearly can someone admit they’re grasping for an answer….

The origin story of a systemic lie. If you don't know how to control money, how about rates? Volcker knew what he was doing.

“…father isn’t telling them.”

These excerpts come from excellent due diligence and research from Ritik Goyal and his publication The Monetary Frontier. He’s one of only a few men who see the deceit for what it is, and understands it on the same terms as me. You can read more of his work here on The Myth of Volcker. The Fed Disrespecter movement is growing!

The great wizardry of Volcker isn't that he did anything to exert control over the system, it's that when the Fed was shown to have close to zero control of the money supply by way of eurodollar and offshore activity, he effectively changed the Fed's messaging from "we control money" to "we control rates". Brilliant in its deception. And no one has second guessed the Latter Day Saints of the Federal Reserve since.

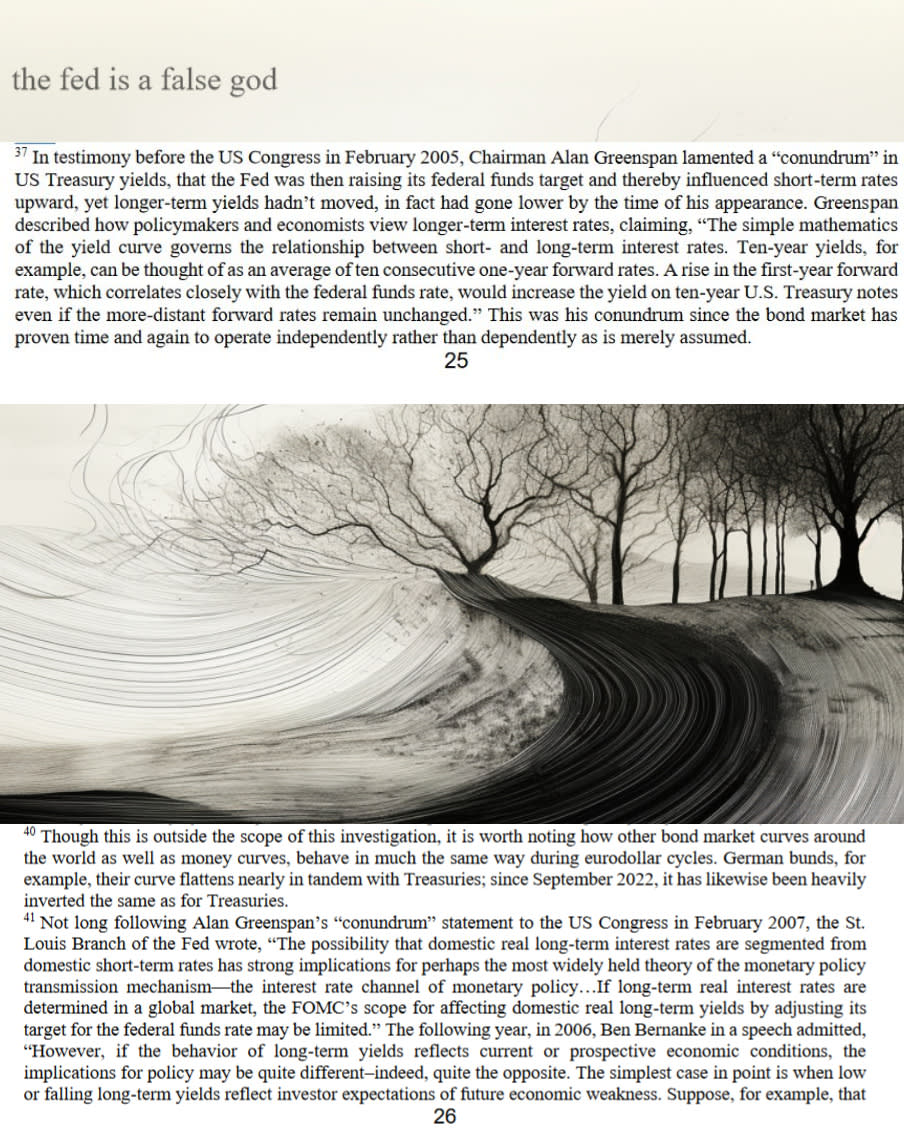

If you’d like to know the academic justification for the “rate control” claims: see below, that's it. That's all there is to it. An academic hope and a dream predicated on the phrase "term premium": manipulate one single overnight bank lending rate (a reserve borrow rate when there is no more reserve requirement!) and you control all the prices of money for a $27 trillion machine.

They’ll admit they’re confused and concerned just like Volcker if you listen closely. Don’t take it from me, take it from Bernanke and Greenspan:

He knows. Deep down, he knows….

You don’t need to “end the Fed”, you just need to stop believing its lies.

Subscribes and shares are very much appreciated. If you enjoyed the essay, give it a like.

You can show your appreciation by becoming a paid subscriber, or by donating here: 0x9C828E8EeCe7a339bBe90A44bB096b20a4F1BE2B

I’m building something interesting, visit Salutary.io

Related essays:

The Fed Part 1: QE, A Mechanical Deconstruction of an Impotent Illusion

Quantitative Easing (QE) does not print money. It does not create new assets. It does not inject dollars into the world that consume resources. It isn’t responsible for asset prices going up. I mean this technically and literally. Each of these claims will be methodically deconstructed and defended in this essay, among others.

The Fed, Part 5: Forward Guidance, Complex Adaptive Systems, and Interest Rates

There's an unfalsifiable claim regarding Fed control: “forward guidance”. It’s a magical phrase, nearly nothing it can’t justify. Markets completely ignore the Fed, yet are still somehow listening to it…

The vibes of this post are just sublime. The art, the arguments, the shear genius of it. What a pleasure to absorb.

Still going over it.

One of the best finance essays I've ever read.