The Fed, Part 5: Forward Guidance, Complex Adaptive Systems, and Interest Rates

The sun doesn't follow a rooster’s “forward guidance” by rising when it crows

There's an unfalsifiable claim regarding Fed control: “forward guidance”. It’s a magical phrase, nearly nothing it can’t justify. Markets completely ignore the Fed, yet are still somehow listening to it…

The sun doesn't follow a rooster’s “forward guidance” by rising when it crows.

A meteorologist does not dictate the weather, he comments on what’s already coming. The weather does not care what he says, and just because it did what he predicted doesn’t mean it was listening to him.

If there were people with religious zeal for meteorology and we’re assured by the Federal Department of Climate that they do in fact manage the weather (I’m sure this department will exist someday and make this claim, give it time), the weather forecast press conference would be a huge event! Will the weatherman raise the temperature or lower it? Will he bring rain? What did the meteorology “forward guidance” say this week? Have the winds and sun priced this in yet??

Now imagine a federal meteorologist who “forecasts” weather that’s already happened, then tells you his plans for the weather next week. Afterwards, everyone says he was responsible for all of it. When he gets it completely wrong, don’t worry, the weather is simply anticipating the forecast he’s going to give in the future.

I was kidding, this department basically already exists, it’s called the Federal Reserve.

We used to do the same thing with rain dances and chanting, and when a storm came attributed it to the chants. When you watch an FOMC meeting, picture a rain dance. We're more enlightened in many ways than our ancestors, but our magical beliefs about man’s control of the complex and unknown persists, even if wearing a tweed jacket while doing so.

Creationism and Forward Guidance: Unfalsifiable, Never in Doubt

Have you ever debated a creationist? It’s some variation of this:

”These dinosaur fossils contradict your claim.”

”God put them there to test our faith. God did it, just like Noah's Ark said.”

”The millions of light years it takes some starlight to reach earth shows your theory is wrong.”

”God’s light cannot be measured. This is a faith test, I won’t let you shake it.”

Rinse and repeat. The tactic is obvious: it doesn’t matter what objective evidence you provide, it’s always something the deity did preemptively. Found something that contradicts God’s story? He planted it there to test you. Nothing a couple mental somersaults can't fix.

There's no scenario where hard facts refute this. It’s always God’s will. Equipped with this rhetorical tactic, you can now provide unfalsifiable post-hoc justifications for your beliefs. This isn’t an intellectual discussion; one reviews evidence, the other promotes scripture.

This creationist dedication to God’s will is the same mentality that otherwise entirely rational people have with the Latter Day Saints of the Federal Reserve. Is the bond market totally disregarding them? Faith test! The bond market is actually just anticipating the *future thoughts and actions* of the Fed. Forward guidance pricing in something something! Amazing grace.

"Don't fight the Fed" is a religious incantation.

Emphasis: we’re not talking about a law of physics or mathematical axiom here. We’re talking about how a government institution impacts a complex adaptive system (the economy). If you think “the science is settled” here regarding how things work, you’re wrong.

Economics is, at best, an advanced logic exercise. It isn't a science because it predicts next to nothing and struggles to reproduce findings. If it’s science it has predictive abilities and is replicable. Most social "sciences" fail here.

The uniform beliefs everyone has about Federal Reserve power were incessantly injected into them via barrages of FOMC flamboyance, academic orthodoxy, and media fixation. I've yet to see opposing analysis given any credence, only “experts” that parrot 96% the same thing.

There is little scientific about economics and its understanding of complex adaptive systems (to its credit, it does try). So how is there North Korea-tier consensus on the Fed? Perhaps some inquisitiveness is warranted. That's the essence of this series.

Why is the takeaway on this deeply unscientific institution -- that consistently can’t predict what it purportedly controls -- so monolithic? Why is the conclusion “they’re incompetent” and never “they’re impotent”? I believe the answer to this confusion is clear.

Fed creationism will preach the Fed is so omnipotent it makes the market do what it wants not with actions, but words: aka "forward guidance". But sometimes not even words! With…. thoughts? Because the bond market often ignores Fed declarations. In fact, it's been doing so a lot recently.

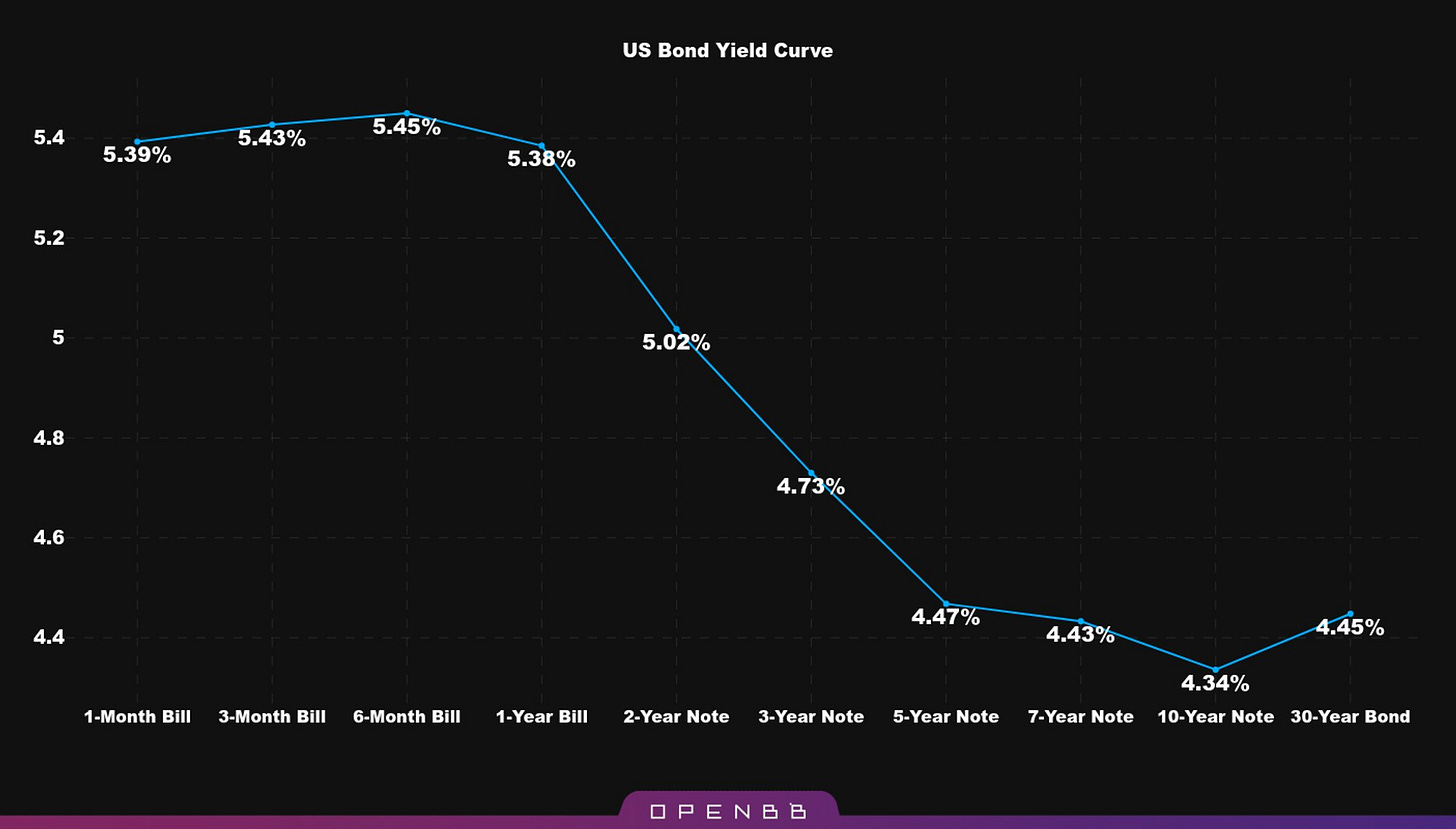

The Fed has very loudly been "raising rates" for around 1.5 years. Yet the yield curve has looked roughly like this for about a year now. This is what we call an inverted yield curve.

The yield curve is so badly inverted there’s only one other time it’s been worse in recent memory.

The Fed Funds Rate (FFR) is 5.25%-5.5%. The 10yr Treasury is ~4.4%.

This means the rate the US government pays for 10yr debt is 4.4% annually, and the rate for overnight bank lending is ~5.35%. This is a perversion. The bond market is completely ignoring the Fed. Again.

All things equal, longer debt should have higher yields as it carries more duration and default risk (Treasurys just duration). This inverted curve is saying “we don’t care how loudly you raise the FFR, inflation and GDP dictate we’re heading lower.” (This is covered in intimate detail in The Fed Part 4).

The Fed is capable at manipulating short rates (<2 years) via the FFR, which is the only rate of consequence it controls (FFR = interbank borrowing rate). What it has zero control over are Treasury bonds. Why do these bonds matter? They dictate real-life borrowing costs (covered thoroughly in The Fed Part 4).

Fed Creationism and Economic Reality

Fed acolytes will counter with a variation of:

“Bonds are still listening to the Fed actually. They're predicting the Fed will cut rates. They’re anticipating what the Fed will do in the future, even if the Fed says it won’t do it.”

Let’s be clear about this claim: the Fed is saying and doing one thing. The bond market is subverting it completely, and yet the bond market is still somehow under the Fed’s will… because it’s predicting what the Fed will do in the future vs what it says….

Creationism. This is “God did it-ism”. Magical thinking.

The observation consistent with reality is that the bond market is doing what it does based on economic factors (GDP growth + inflation) and it doesn’t care when the Fed and its lagging indicators realize what it’s already figured out. The Fed tags along. Followers.

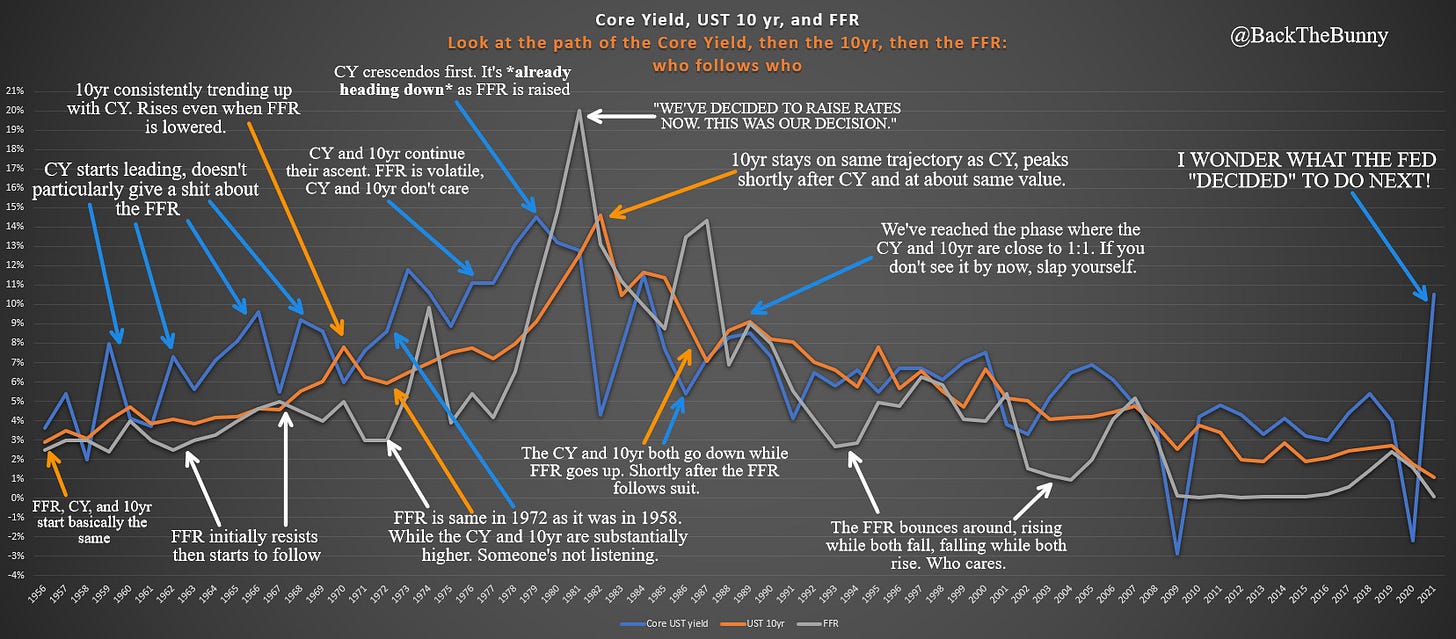

Here’s GDP growth + inflation and the 10yr Treasury going back 70 years. Please do look at the end when inflation + GDP spiked, I wonder what the Fed “decided” to do next!

The answer is not that bonds are somehow predicting Powell’s next moves, even when he says “we’re not going to do those moves.” If you consult interest rate breakevens they tell a similar tale on inflation. Because they operate in reality, not 12 people's delusions of grandeur.

Interest Rates: An Output of a Complex Adaptive System, Not an Input.

Interest rates are an output of a complex adaptive system, not an input.

There is no more critical, indispensable financial indicator than the cost of resource information; this dictates resource allocation, which informs economic activity.

This is what interest rates are.

Money flows (information) are directed by them. Vast amounts of economic data are embedded within them. Economies are complex adaptive systems; their most vital outputs are interest rates.

Interest rates are biomarkers of an economic organism. They are outputs, like blood pressure or a heartbeat, not inputs from a doctor or government bureaucracy.

Like biomarkers, they can be massaged, but you are never in actual control of them, and you suppress the signal they provide when you attempt to manipulate them.

When it's internalized that the most critical output of a vastly complex adaptive system is not something a panel of 12 guys controls with buttons.... then this series and evidence I've compiled will begin to make intuitive sense.

You don't need to "end the Fed", you can simply stop believing, subscribing, and regurgitating its lies.

It's fundamentally communist thinking to believe you can (or even should) control resource distribution, information, for a complex adaptive system. Our simple monkey minds can't govern it. For similar reasons, you also shouldn’t manage the weather. Your models are lovely but I'm sorry, this is beyond your abilities to forecast and control. You do not dictate to emergent phenomena and Complex domains, they dictate to you.

The Fed is dressing up the same "state employees allocate resources better than the economic system" thinking that a communist-led economy has when they say "I will make interest rates be X today". They're just doing it with optics that present differently to the uninitiated.

It's revealing to me the communist undertones that the Fed/the West have when they believe they even should manage rates, independent of if they can. Pure hubris and USSR lite thinking.

Fed Forward Guidance: A Tragic Comedy

Now let’s look at some recent examples of reality calling the shots and how “forward guidance” Fed creationism is about as useful as tabloid gossip. Let’s simply observe the world around us, what the Fed explicitly says, and what the market does.

I have receipts for all of these. I literally went back and hunted out articles, press conferences, statements, etc. and took out these headlines. When you see it, you can’t unsee it.

Rates persistently go up while the Fed howls rates won’t go up for many years. I get we're starting from a low base, but those increases during strident insistence otherwise from Powell and Co. don't deceive. Look at how all that "forward guidance" is respected and informs the cost of money.

Also within that chart, I show the change between when rates bottomed vs when the Fed “pivoted”, then the delta between the "pivot" and the first FFR increase. Does the trend look different to you? Because it sure looks like a continuation of what was already occurring to me.

What was the bond market pricing in while the Fed said "don't go up"? Inflation! Because that’s what informs the price of money: inflation + GDP growth. This is incontrovertible reality.

Now that they’ve been “raising” rates for 1.5 years, let’s check in on how those rates have reacted. With the Fed hiking so aggressively, we ought to see that in real life right…

Markets are reflexive beasts. The Fed's cognitive stranglehold dominates psyches, but it has little power outside of a belief it has power. Just press conferences and fanfare, no concrete transmission mechanisms to govern the things it says it does.

I reiterate: what was going up the entire time? Inflation. History shows macroeconomic variables no man controls are the maestro of what sets interest rates.

Here’s 70 years of the 10yr US Treasury, FFR, and what I call the Core Yield, which is the sum of GDP growth + inflation. Look at who leads who. Look at who tags along.

Meteorologists don't get credit for controlling the weather by making forecasts. Roosters don't "forward guidance" the sun by crowing before it rises. You have the sequence exactly backwards when you believe otherwise. Believing in monetary policy is like thinking the rooster is powerful.

I encourage you to really internalize those charts. Give them all a second look. View things from a true first-principles lens when you do. If no one told you want to think, what would you think?

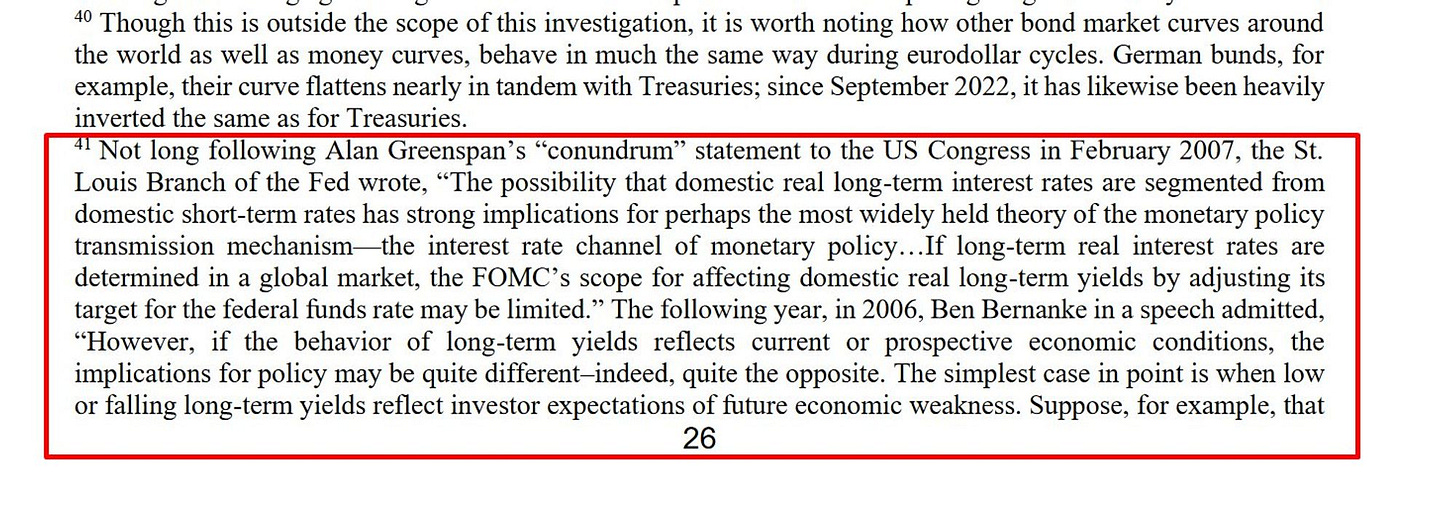

Even the Fed has quietly expressed concern (a “conundrum”) over their abilities here...

Rejoinder: “The Fed gives forward guidance that broadcasts these moves years out. This is how they lead the bond market from behind. Have you heard of the Dot Plot?”

The Fed’s Dot Plot (DP) shows each FOMC member’s forecast for rates; the dots represent what they believe the FFR will be at the end of each year for the next three years.

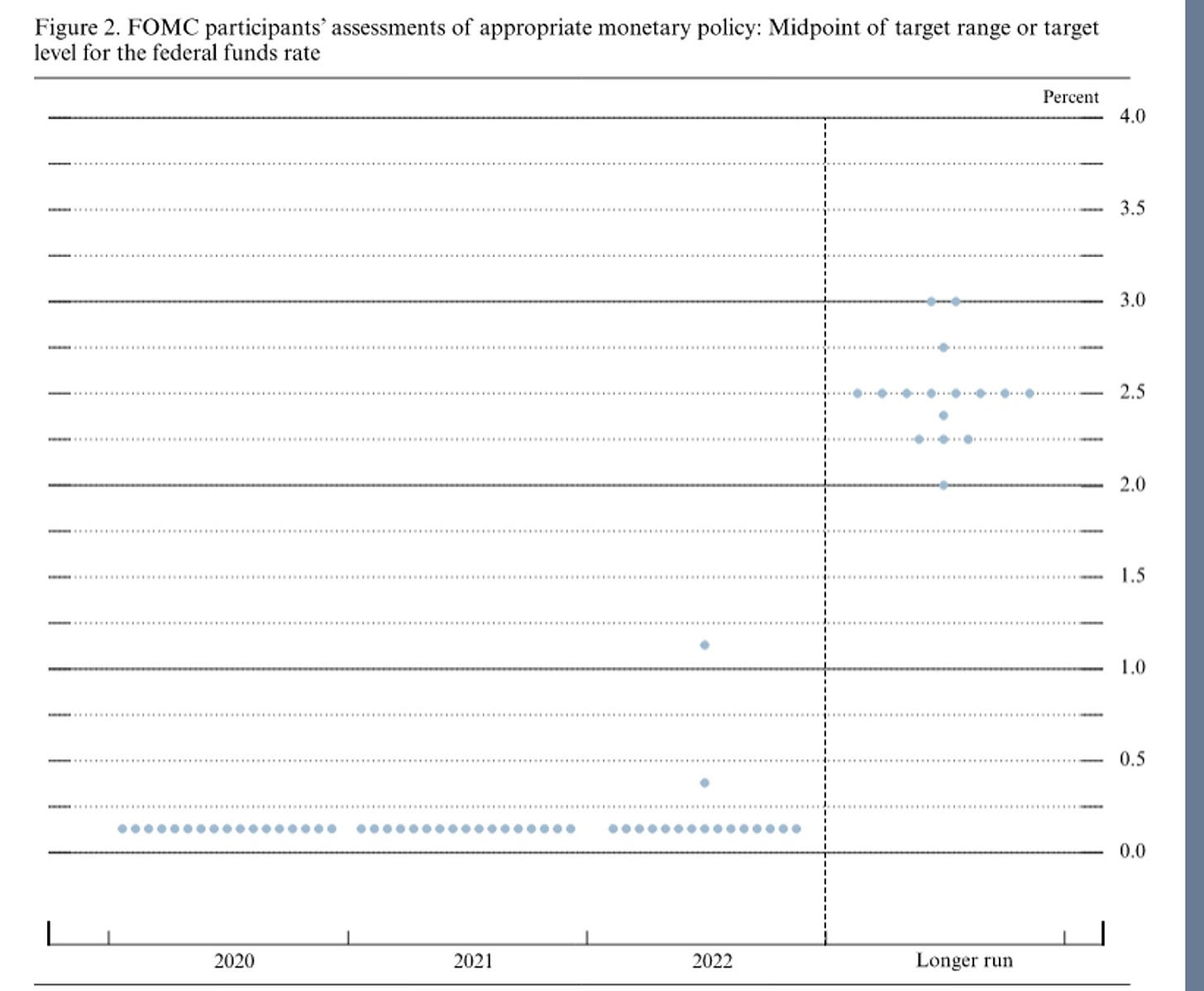

Take a look at what the Fed explicitly broadcast in a “forward guidance” kinda way in June 2020. Rates at ZERO from 2020 - 2022.

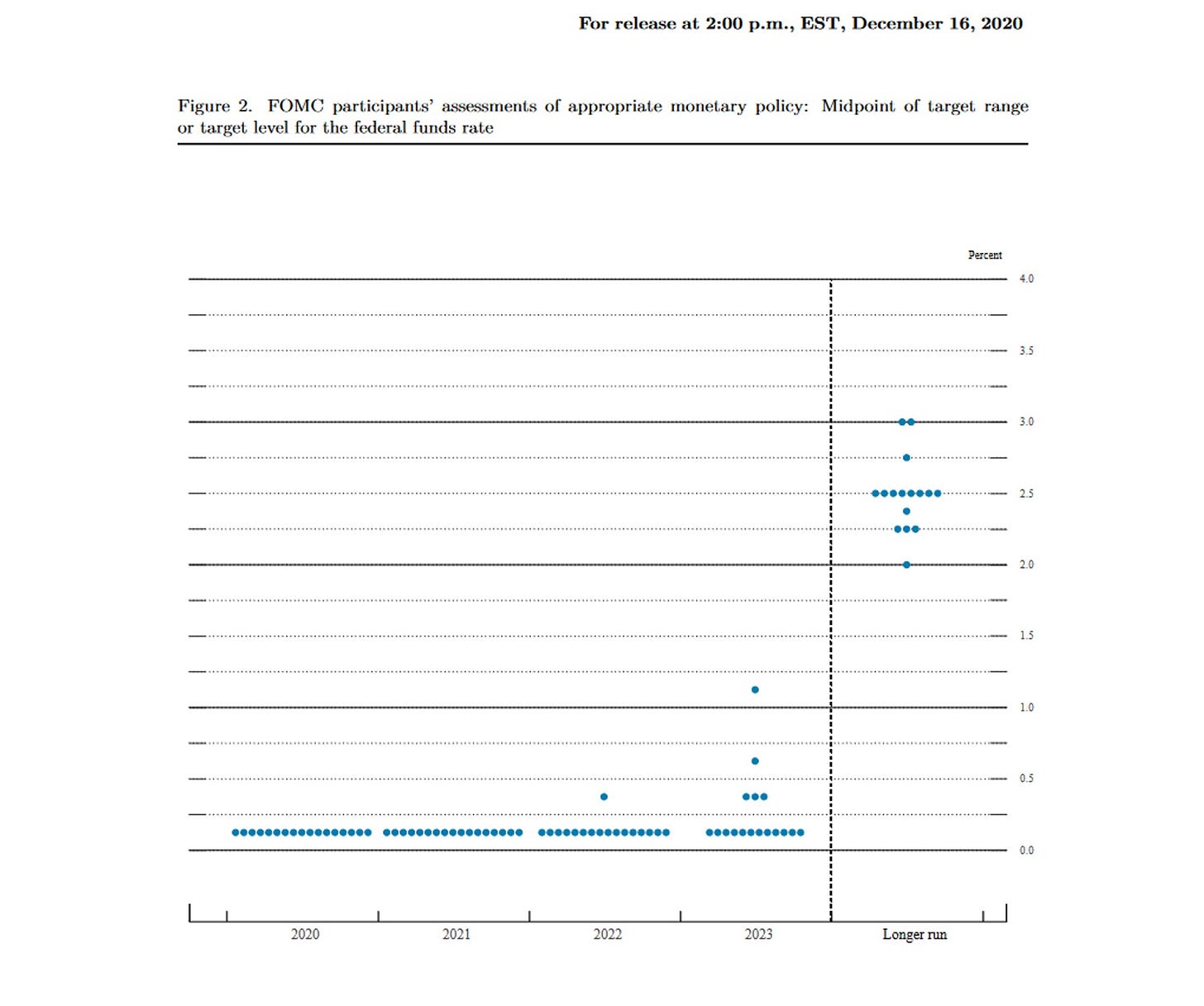

Dec 2020 Dot Plot: by this time rates were clearly trending up. Look at this, then go look at the previous charts, and tell me who controls who. The market knew raising interest rates was what the Fed really wanted even while the Fed said the opposite, or...?

Interest rates at zero through 2023!

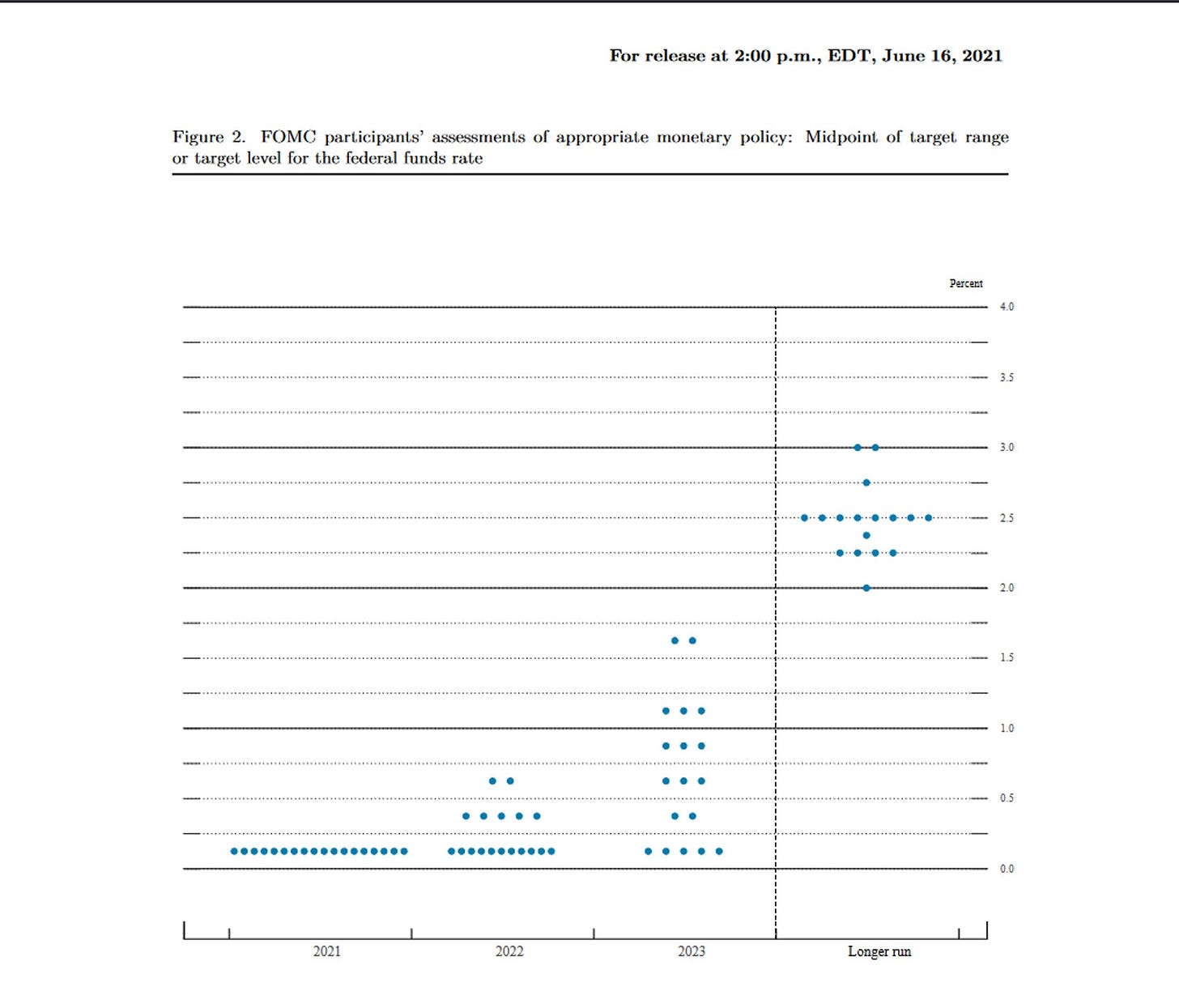

June 2021 Dot Plot: as rates rose and consolidated, then went higher again. The Fed still saw rates at basically zero in 2022 and ~1% by 2023. The bond market must be absorbing the Fed's will via clairvoyance!

These Fed Dot Plots would have been more useful as toilet paper. I’m being forceful on my ridicule here as it’s warranted when you’re attacking institutional-grade deception. This should be jarring and a little disorienting to internalize. Disrupting axioms is not done meekly and these are weapons-grade lies put out by this government agency.

The institution that “controls” rates cannot predict them to save their lives, because they do not control them.

I’m not asking you to agree with me, I’m imploring you to examine extraordinary claims critically. My claims are NOT extraordinary, THEIRS are. You have been psyoped into believing otherwise.

This would be an obvious manipulation for any other profession or government agency, yet for the demigod Fed we throw evidentiary standards out the window and rain chant accordingly.

I have a genuine question: if you read this essay as well as Part 4 and 6, what more do you need to see on the interest rate question to have your faith shaken that they don’t actually control this? Are you able to have your mind changed?

Earnestly ask yourself “how could my mind be changed?” If you can’t think of a way… is that not the essence of religious thinking? No standard of proof for the belief; faith is all you need. Maybe pick a better church than this government one?

Are you operating on evidence or faith when you listen to the government press conference describing how they control the Complex machine with buttons? How much do you trust MSM, the government, and social-science academia to forthrightly impart the truth to you?

When you encounter an unquestionable truth no one dares doubt, it’s probably where inspection is needed. When it comes to political institutions, humans do not collectively come to such monolithic conclusions… unless religiously inspired.

Thank you for being curious with me. Please share. Spark a little curiosity. Plant a seed of doubt.

Subscribes and shares are very much appreciated. If you enjoyed the essay, give it a like.

You can show your appreciation by becoming a paid subscriber, or by donating here: 0x9C828E8EeCe7a339bBe90A44bB096b20a4F1BE2B

I’m building something interesting, visit Salutary.io

Continue learning:

The Fed, Part 4: The Federal Reserve Does Not Control Interest Rates

We are here to discuss the granddaddy of Federal Reserve claims: we control interest rates.

The Fed Part 1: QE, A Mechanical Deconstruction of an Impotent Illusion

Quantitative Easing (QE) does not print money. It does not create new assets. It does not inject dollars into the world that consume resources. It isn’t responsible for asset prices going up. I mean this technically and literally. Each of these claims will be methodically deconstructed and defended in this essay, among others.

awesome write up as always!

Thank you for posting parts 1-3 here on Substack! Some of us don’t have easy access to Twitter (blocking due to authoritarian regimes), so we appreciate it!