The Insect Method: Tariffs, Labor, & Surpluses

The laws of accounting and structural nature of deficits

This is Part III of Midrange Jumpers for the Middle Class. A series examining different-yet-connected economic dislocations, social imbalances, and structural forces that erode the center.

Trump threatened to tariff Canada and Mexico recently. I understand it was nominally about fentanyl and immigration/border issues, however he’s also done it in respect to trade.

This essay is specifically regarding tariffs as a trade strategy and as a means of mitigating deficits

Terms:

Current Account: the balance of trade in goods and services

Capital Account: the balance of investment flows between countries

These must always net out to zero, which I’ll refer to as the Balance of Payments. An increase in one always results in a decrease in the other, and vice versa.

The Collective Nature of Surpluses and Deficits

When deploying tariffs, keep in mind who your adversaries really are.

The threat of tariffs on Canada and Mexico misses a fundamental, broader point about trade deficits: to address them, we must first understand their root cause, meaning who’s responsible for them. The global trade system isn't just a series of bilateral relationships, it's an interconnected network where surplus nations create deficit nations by necessity.

In this system as it currently stands, Canada and Mexico are not our opponents; in a way, they're fellow victims of a larger dynamic.

Canada and Mexico are also deficit nations. Globally, this means they're actually helping reduce the US deficit by absorbing the global savings that surplus nations must export as a result of how the Balance of Payments settles.

Here are the largest current-account deficit nations over the last ten years, listed from the bottom up (US is the biggest):

The next eleven-largest trade deficits:

Not only are Canada and Mexico deficit nations, they persistently run deficits. This is critical. It should make you recalibrate the degree to which you see them as friend or foe in the global trade landscape.

If a nation exports a lot and doesn’t import a commensurate amount, it simply means their domestic demand is weak. It’s not a sign of strength, it’s a sign of a feeble domestic consumption. It should not be seen as exporting success, but rather an importing failure.

The purpose of exports should be more imports; exports are real costs, imports are real benefits. When economic behaviors do not reflect this, a pernicious strategy is taking shape.

Surplus nations' domestic demand cannot consume their own production or the exports of other nations, because they've systematically suppressed the wages of their workers. So they export this weak demand to deficit nations. I’ll touch more on this towards the end.

If global trade were driven by comparative advantage, what free-trade types will tell you is the case, persistent major trade imbalances would not exist, because your exporting success necessarily sows the seeds of your future exporting disadvantage. There would be a natural equilibrating force that manifests between currency strength and exports that results in something approximating mid-to-long-term trade parity between nations. This is not occurring.

Why are some countries so insistent on shipping away all these exports and getting no imports in return? It’s because they’re getting something else, and you’re losing that trade. They are exporting weak demand on to you, and gutting your industries in the process.

You are in the domain of religion, not economic thought, if you think an action is always good, and the other always bad. The real answer is always… it depends.

People like Rand operate on simple Manichean grounds in how they assess this global dynamic. Tariffs = bad! No, it depends.

The “tariffs are a tax” crowd are basically echoing a religious chant. It’s pure first-order visceral reaction that sees tariffs and their impacts in a vacuum. It demonstrates no Nth-order understanding of the structural dislocations that tariffs can address if used properly.

Tariffs and trade intervention absolutely have their place. If you think you don’t have trade policy, that just means you’re defaulting to the trade policy of your counterparty. You don’t get to not have it, you either have your own, or the other guy dictates his rules to you.

A nation’s industrial policies can indirectly act as de facto trade policies, because it substantially influences it. One informs the other. This statement will make sense towards the end of this essay.

Here is a functional breakdown that shows how it’s happening.

You Must Understand the Accounting

For the US, hurting other deficit nations will only exacerbate your deficit.

As long as surplus nations keep exporting savings (capital) to deficit ones — which is a mathematical requirement for how nations must have their capital and current accounts reconcile — then harming a fellow deficit country only makes your deficit bigger.

If you weaken other deficit economies, the excess savings that leaves the surplus nations still must go somewhere. If Canada and Mexico are now less attractive destinations for that capital (because you've harmed their economies with targeted tariffs), that means those savings will now head to the US: the global dumping ground for surplus nations.

Getting capital dumped on you from surplus nations sounds like a good thing. It is not. Because it MUST make your trade deficit larger. By accounting necessity, this is so.

Trade settles globally not bilaterally. Trade is a global system, not a series of isolated relationships of two countries trading with each other.

By economic law, one country's surplus results in another country's deficit. Take this concept writ large, and you will see global trade as one big Balance of Payments pool, where deficits and surpluses have to clear amongst all participants.

Think of global trade like a balance sheet that always sums to zero. When countries like China or Germany send more capital overseas than they receive, this automatically forces the inverse effect in recipient country’s trade accounts: they must import more goods than they export. It's not a choice, it's a mathematical requirement. When surplus nations park their excess savings in US markets, they're essentially forcing America to run a trade deficit.

It’s the chronic surplus nations that mandate a US deficit follows suit, and the other deficit nations are ameliorating the deficit you'd otherwise have in this global trade environment, because they are fellow absorbers of surplus-nation savings. The savings that flows into them means their deficits are larger as a result, meaning they’re defraying the deficit you’d otherwise have without them.

If Canada and Mexico weren’t there, the US deficit would be bigger. By the physics of accounting, this would be so. It may feel counterintuitive, but it’s the way it works.

A current account (trade) deficit is always matched by a capital account surplus of equal size. That means money that flows into you is de facto creating a dynamic that results in a trade deficit of the same amount.

Here’s how it works:

Surplus countries have high savings rates, as a result of weak domestic demand

Global excess savings seek safe assets

US has the deepest, most-liquid capital markets

Capital flows into US

This FORCES a US trade deficit. There is no reality where this could not be so.

The US has basically no control (intentionally so) over its capital account, and it doesn’t seem to really grasp what that implies for trade.

Economists and armchair commentators who need to explain this with a human-readable narrative will give you some flavor of “Well China and Germany are just hard workers! It’s the culture! And US culture likes to spend and not save”. This is wrong.

The deficit is a consequence of how everything unavoidably settles when you have open borders for capital and certain nations utilizing mercantilist strategies. If you choose to have no trade policy in response to this, then your trade policy becomes the inverse of whatever your adversary’s trade and industrial policy is. You never get to escape having one. You either create your own, or abide by the rules of your counterparty.

Thus, you should view fellow deficit countries as allies against the surplus nations, because that's the role they actually serve alongside you in the absorption of global excess savings.

The Insect Method: How Sustained Surpluses Are Achieved

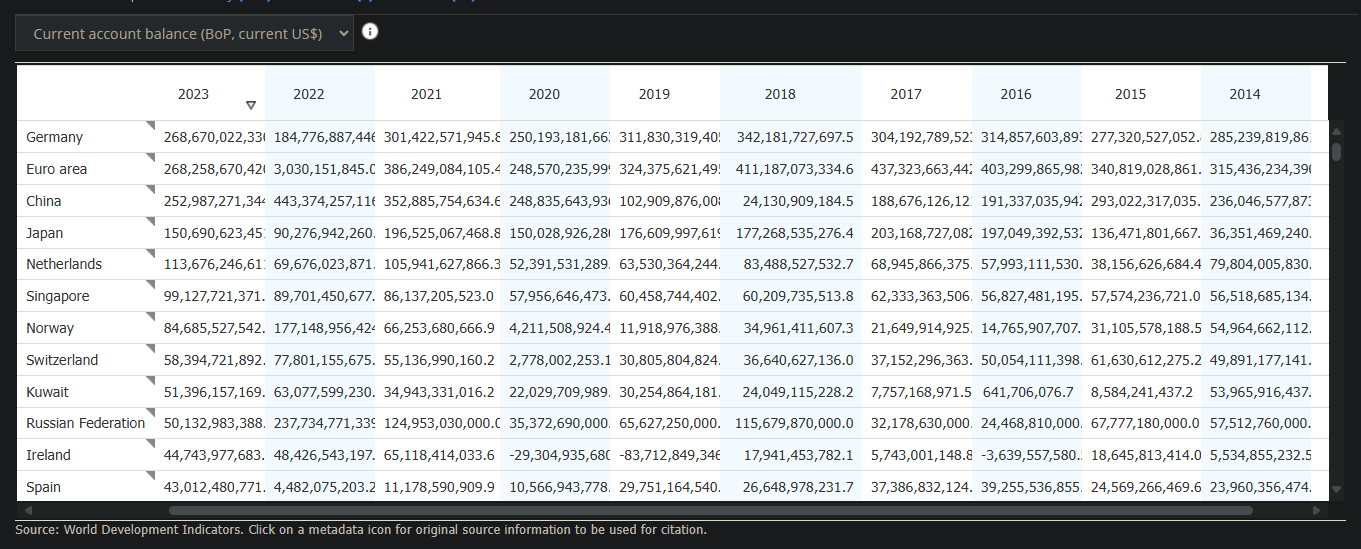

Here are the top surplus nations over the last ten years from World Bank, listed top down:

It’s often the case that persistent surpluses are accomplished via varying tactics of domestic wage suppression. Germany and China are particular culprits.

Germany and China are not “more competitive” due to some Ricardian “free trade” advantage. They have taken the perverse approach of curtailing their middle class of its share of GDP growth, which is a fancy way to say structurally diminishing wages.

The popular story is that Germany and China's trade success comes from superior efficiency or work ethic. The reality is something different: through their industrial policies (which manifests as de facto trade policies) they’ve systematically underpaid their workers. When you pay workers less than their productivity warrants, you're not being "more competitive", you're just shifting money from workers' pockets to exporters' profits. This isn't free trade; it's wage suppression dressed up as economic efficiency.

If your labor input is cheaper because you subvert the wages of labor, it’s not all that surprising where your “advantage” comes from. This is the Strategy Of The Bug.

How do they do it?

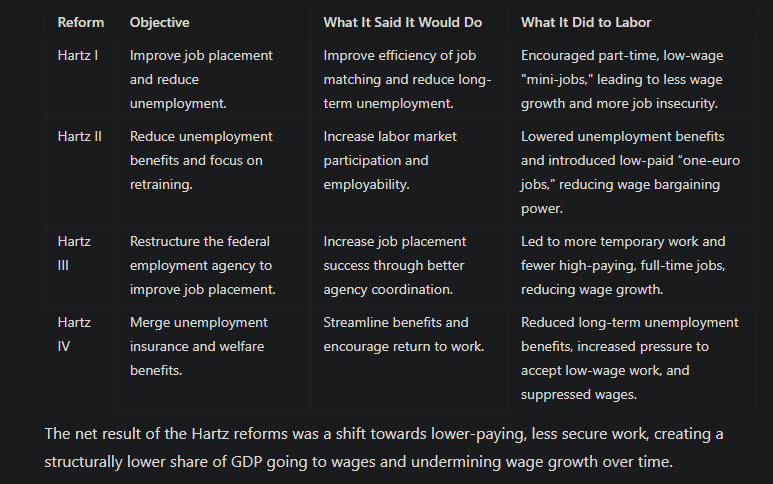

In Germany, the Hartz reforms from the early 2000s systematically sabotaged labor and gave it a smaller share of GDP gains. Germany didn't magically grow more competitive because its workers became more productive or because they culturally decided to “save more” or “work harder” (people love these just-so story-telling narratives rather than looking at the raw mechanics). The environment always dictates the expression, so how did the environment change?

Rather, Germany achieved its exporting dominance because workers received a smaller share of their productivity gains. This isn’t "efficiency" but rather a transfer of wealth from workers to businesses. From domestic importers (households) to exporters (manufacturers).

German domestic impact of the Hartz reforms:

Worker compensation stagnated while business profits increased

Private-sector investment declined (because domestic consumption weakened)

The household share of GDP fell

German household consumption dropped

Savings rate rose sharply as a result

Why did savings rise: due to these reforms, income flowed disproportionately to the wealthy, who do not spend each marginal dollar they make.

Thus savings necessarily rises as an accounting function when money flows to the upper class and isn’t used for consumption. It’s not some cultural “well Germany just likes to save!” narrative that people try to sell. The true reason is not found in social commentary, but rather financial physics.

This diminishment of labor benefits the rich and business in a very myopic way. Because when your middle class has less income, it spends less, and that means you sell less. You are sowing the seeds of your own weak domestic demand.

It's the middle class that actually spends each marginal dollar they make! They’re the consumers. If they get paid more, you can sell more! Rich people don't spend their extra income, they invest it. A lack of consumption is synonymous with weak domestic demand. And if that money isn’t spent, it’s dumped into deficit nations.

In China it's the Hukou system that intentionally vitiates labor rights and wages. Think of it like the US H1B program, but on steroids. It creates a servant-like, slave-wage underclass that China uses to its exporting advantage.

To compete with this is to desire to live like an insect:

This is not the only way China facilitates its mercantilist surpluses. It also manipulates its currency, keeping it artificially depressed. This is of substantial benefit to manufacturing (exporters) at the expense of households (all households are effectively importers, because they only buy goods and do not produce them). A weaker currency aids exporters and is a hinderance to importers.

Important: What matters is whether workers' compensation reflects their productivity. It's the productivity share of GDP where this dislocation has its impact. That's where the Hukou and Hartz systems take their toll.

To illustrate: on a GDP/worker basis, Chinese workers are around 20% as productive as US ones. If they earned ~20% of the wage that'd be fine and not a competitive advantage. But they don't, they get 10-15%. This is a major difference.

The average German worker is around 85-90% as productive as the US one, yet his wage is 75-80%. Same manipulation.

Both China and Germany have productivity-income gaps relative to the US and it allows their sustained surpluses to exist: the average Chinese worker produces about a fifth of his American counterpart, but consumes an even smaller fraction of that output. Same for Germany.

China and Germany get away with their mammoth surpluses because they've systematically eroded their citizens' productivity share of GDP, and they've nuked their own domestic demand in the process. All to gain export advantages over nations that don’t view their middle class like bugs. Or, less like bugs.

Thus, because they have decaying domestic demand as a result of their internecine industrial labor policies, they dump their trinkets and excess savings onto other nations; this results in deficits for recipient countries. This is what I mean when I say "exporting weak domestic demand": they can't sell their trinkets domestically, so they ship them overseas.

A global race to the bottom ensues on account of a cancerous globalism wage assault, and the middle class bears the brunt of it. As the only way to compete in this shitty worldwide competition is to continually undermine wages.

I hope this illustrates why certain people love the US H1B program so much, as well as the obsession politicians have with allowing in infinity immigrants. They present it as “inclusion” “refugees” “diversity” and all walks of warm-and-fuzzy platitudes. This is a lie. It’s a wage-suppression technique.

What else keeps wages down? Labor supply. What increases supply? More warm bodies. Your wages can’t rise if we’re importing a bunch of guys that will work for half the price.

The Netherlands tactics:

South Korea:

China and Germany are the two most-egregious examples. They and other habitual surplus nations in large part attain their current-account feats via insidious labor (industrial) policies. They are the ones who deserve to be targeted by the US and other deficit nations. Tariff them collectively to high hell. They are responsible for global deficits, by design.

Don’t worry “free traders”, what you have here is not free trade anyways. You have mercantilist subversions that you naively have allowed to happen at your expense, because you prefer simple answers like “tariffs are tax” rather than actual analysis.

The best time to address this was when it first started happening, the second-best time is now.

Solutions

Do you understand the nature of the balance of payments yet still can’t shake the negative connotation of tariffs? There’s another option: tax the savings (capital) that surplus countries dump into the US.

This solution, despite being a perfectly correct approach to addressing this unsustainable global dynamic, often gets people the most riled up, purely due to its optics. “Whoa buddy why would you tax those who want to invest in the US!”

They are not investing, they are dumping.

The US is AWASH in capital. We are not capital constrained, at all. Not even a little. This simplistic refrain pretends like the US is a developing nation that couldn’t fund itself if surplus countries didn’t know where else to put its savings. We enable Germany and China by giving them a nice comfy place to park their money. They distort financial markets and inflate asset prices in the process, and we require none of it to actually finance ourselves.

REMEMBER: a capital account surplus (money coming in) must produce a current account deficit in equal kind. Tax inbound capital, reduce the deficit, by accounting necessity.

This capital dumping also contributes to adversely strengthening the US dollar. An unfettered inflow of savings makes the dollar appreciate disproportionately to other currencies, undermining our exports. Over time, this steady distortion erodes entire industrial sectors; not because American companies become less efficient, but because they're competing on a tilted playing field.

When the dollar is artificially strong, it inherently degrades our exporters’ (manufacturers) competitiveness and guts domestic industries in the process when it persists for too long - as the very nature of unrestricted globalism results in a destruction of the middle through expected-value-maximizing clustering effects.

From Touching Soul, Touching Senses: The Art You Deserve:

“China (and other chronic surplus nations) often intentionally depress domestic wages below their productivity levels; this is a substantial competitive advantage, because it makes their exports comparatively cheaper, and companies cluster accordingly. We call this clustering effect “globalism” because “strategic business clustering effects based on surplus-nation wage depression” is bad economic branding.

The average Chinese worker is about 20% as productive as the American one, yet he is paid about 10-15% of the wage; similar discrepancies are found in other surplus nations. This is a massive exporting advantage, and why you uproot entire industries and eviscerate the way of life for your middle class. Margins.”

Part of what makes trade deficits/surpluses eventually return to equilibrium is the currencies of surplus nations naturally rise relative to deficit-country ones. As deficit-country currencies weaken (comparatively), this makes their exports more competitive, and balance is restored.

Unmitigated access to US capital markets impedes this from happening to the dollar. The dollar is too strong, and surplus-nation capital dumping contributes to it.

The people who object to taxing capital dumping often have a vested interest in the US dollar remaining a global weapon for geopolitical purposes (Wall Street and the State Department, for example), or simply don’t know what they're talking about. They see everything in Rand Paul first-order-isms. They react to the scaffolding of the action, not the pragmatics of what it fixes. Taxing capital inflows is a legitimate solution to surplus-country manipulations.

Concluding

Fellow deficit countries are not the culprit here.

If you’re a deficit country, fellow deficit nations are mitigating yours; you need to understand the true mechanics of the Balance of Payments to be able to see how this all systematically must settle. Stop staring at headlines, stop telling macro-econ-guy stories, start understanding accounting.

The real economic adversaries of the US are those who facilitate the gutting of its middle class and its industries as a result of the long-term ramifications from the Insect Method. A tragic sprint to the bottom for the middle class is the race we must run if we wish to compete with this.

By accounting law, financial physics, it starts with China, Germany, and the labor-undermining surplus nations. Their industrial policies create trade policies. They impose their will on us when we do nothing. They dictate to us, because we don’t comprehend the Nth-order impacts of their nominally domestic decisions. We absorb the opposite of what they do when we do nothing.

When we talk about trade deficits and capital flows, it seems abstract. Here’s a practical consequence of it:

A factory closes in Michigan because it can't compete with wage-suppressed foreign labor

It's not just those factory jobs that disappear. The local restaurants lose customers. Income for surrounding industries declines.

The housing market weakens

Tax revenue falls

Schools suffer

An entire community's economic ecosystem unravels, all as a byproduct of German and Chinese industrial policy.

When trade is globally interconnected, the “domestic” decisions of one nation implicitly come home to roost in yours. You cannot escape this.

What does this mean for US trade policy? Takeaways for an actual solution:

Cooperation and alignment with other deficit nations

Multilateral pressure on surplus nations

Impose trade rules that penalize systematic wage suppression: the true driver of global trade imbalances

Stop targeting fellow deficit nations like Canada and Mexico. They're absorbing surplus-nation savings that would otherwise produce larger US deficits.

Consider tools beyond tariffs that address root causes/incentives rather than the symptoms, such as taxes on capital flows from surplus nations. Never forget what a capital account surplus must mean for your deficit.

The goal isn't to start a tit-for-tat trade war, but to impose a more balanced global trading system where worker wages reflect their productivity, one where surpluses can't persist indefinitely through never-ending wage destruction.

Know your enemy. Don't do pageantry for flashy headlines. Do real solutions and focus on distal causes. Systematize, stop storytelling, only then can you see it.

The middle must be upheld.

Subscribes and shares are very much appreciated. If you enjoyed the essay, give it a like.

You can show your appreciation by becoming a paid subscriber, or by donating here: 0x9C828E8EeCe7a339bBe90A44bB096b20a4F1BE2B

I’m building something interesting, visit Salutary.io

a comment and my reply, namely for those who see this analysis and think it's economics; it is not, this is accounting. accounting has mechanical functions, not theoretical. I hope this further illustrates:

COMMENT:

The logics is correct but please know that the only accounting identity involved is that if you account for both legs of a transaction, one positive one negative, then things will balance.

It’s about the real world, not the painting we make of it.

MY REPLY:

This comment is superficially right, but profoundly wrong in what it implies. The confusion here is treating this as if we have agency over what to account for. We do not.

The Current Account and Capital Account relationship doesn't depend on "accounting for both legs": because one leg necessarily creates the other. They're not independent variables you can manipulate separately.

When China runs a $500B trade surplus, others MUST run deficits totaling $500B. This isn't a choice or a painting, but undeniable arithmetic.

Every dollar of excess savings exported from Germany or China has to be absorbed somewhere. The US doesn't "choose" to run deficits, it's forced to when counterparties run net global surpluses. To disagree with this statement is to reveal accounting illiteracy.

The Current and Capital Accounts are dyadic: each leg defined and constrained by the other. Saying "if you account for both legs of a transaction" is a truism. It's impossible to not account for both, because one creates the other, and vice versa!

He's doing what almost all do: ascribing top-down stories to what is axiomatic at the baselayer. It's precisely this kind of thinking -- inverting causality in the process or seeing it only as mono-directional -- that causes confusion regarding tariffs, trade, and rectifying imbalances.

If you change one side of this accounting equation, you must change the other. Decrease one, you force a raise for the other. You do not need any economist "paintings" for this, only accounting. It's called a 'balance sheet' for a reason.

This becomes much clearer when you understand some elements of life always adhere to bottom-up rules, and are immune to top-down narratives about why they exist. Under certain conditions, certain traits will always exist: know the conditions, discard the stories.

Fix one side, the other side follows suit... it doesn't matter what story you tell.

Canadian friend here, I think Trump agreed with you on Canada being a friend, if not friendly (Bannon was Sloppy Steve for a bit,