Generations of War, Crypto, and Business: Part 2

The US fought wars to win its highly coveted soft power. It will require another one to take it away.

Previous writings that this piece builds upon:

Historically, generations of warfare and business have closely correlated. However, there’s a lag between them: warfare is roughly one cycle ahead.

Using militaries as a leading indicator, you’ve been able to predict business behaviors before they’ve manifested. Warfare is compelled to adapt to new dynamics more readily, motivated not by profit, but by survival. I believe war can be a prognosticator for any sufficiently adversarial domain…. like crypto.

Warfare has been a harbinger for business, and I believe it can be for DeFi as well. Using parallels from warfare, what can we expect for DeFi’s future generations? Where is DeFi in its evolution compared with business and war?

This is Part Two of a multi-part series that analyzes business and warfare generations, and draws parallels and predictions for DeFi’s past, present, and future.

Picking up where we left off from Part 1…

4th-Generation Business (Comparable to 3rd-Gen Warfare)

3rd-gen business was the era of conglomerates and middle management. Mega companies led by a professional white-collar class that resembled Mad Men. 4th-gen begins to chip away at that standard; this is roughly the generation that business is currently in.

4th-gen business — AKA the entrepreneurial era — began in the late 1990s. Startups incorporate Blitzkrieg-style approaches (parallels to 3rd-gen war) and are distinctly faster and more mobile than their old-economy counterparts. They quickly propagate and are more fluid and dynamic with their strategies. The comparative shift from bureaucratic professional-manager structures (oligarchical) to the ‘eccentric founder’ one (monarchical) allows startups to act more efficiently and with less bloat. Speed kills.

Backed by venture capital, 4th-gen businesses rapidly go to market and find PMF by streamlining old business categories and creating new ones, disrupting the paradigm previously dominated by corporate structures. 4th-gen business strategy swiftly circles and undercuts legacy companies, escalating the nature of full-contact capitalism. The parallels to Blitzkrieg are clear.

4th-gen companies are more adept in tech-native paradigms, because they were born in the technology, molded by it. Whereas 3rd-gen companies merely adopted the technology (*Bane voice*).

4th-Generation Warfare (One Cycle Ahead of Business)

The lines between soldiers, civilians, war, and politics become blurred. This is guerilla warfare.

4th-gen war is more aptly defined by the participants in the war and their objectives, rather than how the war itself is fought. This generation is led by decentralized nonstate actors who are able to put up serious resistance or even repel more powerful, centralized state militaries. The internet and mobile devices allow advanced coordination and information sharing without the large, slow-moving processes of state bureaucracies.

This levels the playing field, and means sheer might doesn’t always make right anymore.

The 9/11 attacks are a prime example of an effective 4th-gen assault. Terrorism, rebels, militias, etc. performing hit-and-run strikes and sabotage are examples of 4th-gen strategy. State militaries struggle to tactically retaliate, as guerillas often don’t occupy territory and are not clearly identifiable. 4th-gen war and its participants are much less legible to the traditional adversary.

War begins to aggressively incorporate propaganda and disinformation in conjunction with kinetic violence. Psyops and false flags are known tactics, with state and nonstate actors spreading disinformation by way of social media, dank memes, and fake news.

In contrast to 3rd-gen war — which mobilizes societies and has a “win at all costs” mentality — 4th-gen war often relies on proxy combatants who can win simply by not losing.

They don’t have to defeat their traditionally dominant adversaries, they merely have to stay in the game. Persist. This is how 4th-gen goals and interests are advanced and remain visible.

“The conventional army loses if it does not win. The guerrilla wins if he does not lose.” -Henry Kissinger

4th-Generation DeFi

3rd-gen DeFi ends when the US goes mask off, mandating a registered presence in order to legally transact and build onchain. Privacy tech becomes illegal and sanctioned be default. Self-custody will be treated like having a Swiss bank account in terms of disclosures and reporting requirements. Using crypto will be viewed by the DoJ like owning a bong: yeah having one isn’t illegal by itself, but…. we know what it means.

Owning crypto may even be like owning a gun, eg you need a license to “conceal carry” it (hardware wallets) and it must be registered. And some places like NYC may just make it outright illegal. Or so impossible to get a BS license for it that no one even tries (exactly how that city treats gun ownership).

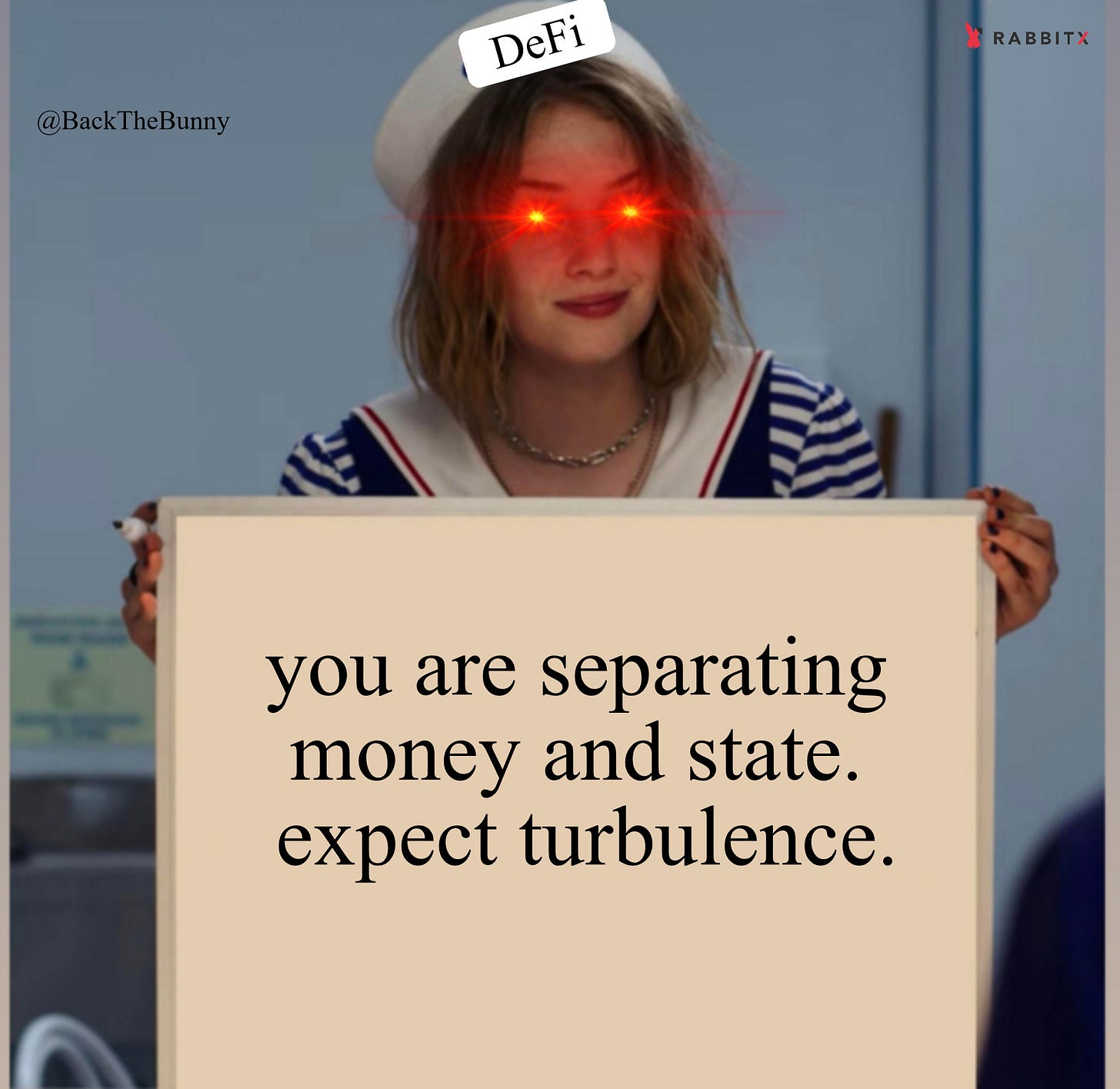

The West will target devs as if they’re criminals for creating open-source software. DeFi builders will learn what low-intensity war means. The space will go dark.

4th-gen DeFi is Crypto’s Vietnam Farmer phase

For the same reason the US hasn’t really won a war since WW2, continually losing to the likes of Vietnamese rice farmers and Afghan goat herders, the SEC and regulators will suffer the same fate.

Why will the US fail to stop DeFi? For the same reason it doesn't win wars anymore. The US military is built to go after Russia, China, Germany… meaning large, legible, centralized adversaries that occupy territory.

Who does the US lose to? Vietnam. Afghanistan. Guerillas. Diffuse. Illegible.

Like the military, the SEC is designed to go after the same things. Regulators are built to oversee Goldman, Barclays, Fidelity.... big, slow, legible targets that occupy office buildings with compliance departments and formal chains of command.

DeFi is built different. Regulators are simply not designed or equipped to keep a global distributed network under their thumb. No one is.

Why can you still use The Pirate Bay? Because it's nearly impossible to stop P2P networks. They're not capable of going after millions of us armed with cryptography, AI, and well capitalized across a global network. The resources and competence simply are not there. The human-capital superiority of DeFi is positively overwhelming against a midwit bureaucrat army.

In 4th-gen DeFi, we are all Vietnam farmers.

4th-gen DeFi will have an omnipresent feeling of low-intensity warfare, meaning attacks that are mostly non-kinetic and subversive. Regulatory assaults will escalate from more symbolic ones on non-core infrastructure (like Tornado Cash, Mirror Protocol, Ripple) to critical ones in an effort to weaken Ethereum’s security (like staking services).

They’ll attempt to shut down stablecoins to destabilize DeFi. They’ll make you register as a business/money transmitter if you run an ETH node. Among other belligerent nonsense that uses a thin facade of legal warfare to advance what is an irreconcilable difference between crypto and the state. I expect the likes of Lido, Rocket Pool, and Tether to be targeted.

Expect nonstop legal games to choke off additional capital from going onchain and to weaken network security.

Methods of Attack

The state will begin to go after companies that provide services to DeFi projects. Cloud computing and internet infrastructure giants (AWS, Azure, Cloudflare, etc.) will treat crypto clients with the same disdain that banks do, as DeFi increasingly becomes persona non grata in the US and across the West (I don’t expect the US or its vassals to have materially different views here).

Cloud providers will ban accounts affiliated with crypto out of fear regulators may target them for aiding money laundering, or whatever pretext the state uses to exert pressure. Banks already do this to crypto companies and users; they’d rather not deal with “high risk” clients, so it’s easier to simply not associate with them.

I made this cloud provider prediction last year, and forms of it are already beginning to happen for AI infrastructure. Cloud providers and banks will be exploited by the state to try and stop DeFi and control AI.

Out of necessity, projects like Filecoin, Urbit, and Render will transform from neat projects we support but don’t rely on, to core parts of the DeFi decentralized stack. This is a good thing. We shouldn’t be so reliant on centralized corporations for our decentralized infrastructure. It won’t be ideology that brings us to our decentralized destination, it will be necessity.

As DeFi is assaulted with random arrests of builders and disinformation campaigns that smear users as criminals, factions of crypto will begin to act not only defensively, but offensively.

Aided by AI and cryptography, mercenary cypherpunk teams will spread their own propaganda and cyberattacks in kind, going after politicians and regulators that have openly abandoned the law. You could even see a crypto Blackwater take shape. We are in a Fourth Turning, after all.

Separating money and state should not be taken lightly. This is an incredibly impactful and detrimental concept to the state. They hate you. They are right to hate you. Everything DeFi does detracts from their control, by design. Do not expect them to just lie down or fight fair.

State’s will arbitrarily seize assets of those suspected of being affiliated with DeFi and hold them indefinitely in “guilty until proven innocent”-style policing, deserting facades of legal due process. This isn’t some unrealistic concept, the US already does a variation of this with Civil Asset Forfeiture.

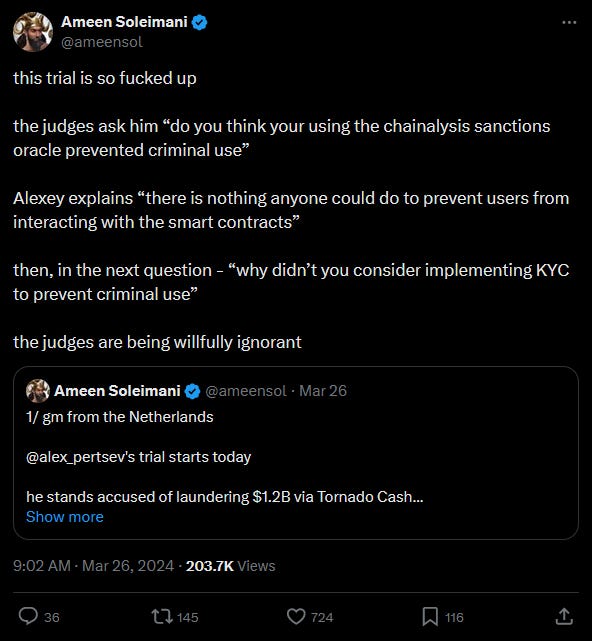

They have already begun doing this with the reprehensible, arbitrary detention of Tornado developer Alexey Pertsev, held for months with no charges. He is now being prosecuted for writing and releasing open-source code.

These people do not care about the law. It’s naive to have a School House Rock notion of due process here. They care about going after an industry they rightfully understand to be disintermediating their soft power and control of financial infrastructure.

OpSec will become a critical component of anything onchain. VPN providers will likely be targeted and servers seized (exposing which have “no logs” policies), as the state ratchets up desperate attempts to put the crypto toothpaste back in the tube.

All DeFi privacy tools will eventually be some form of OFAC sanctioned via language that says anything providing onchain anonymity is illegal. Why? Because fuck you, that’s why. The GAE says no, what are you going to do about it?

You won't win by outright defeating it, but you can by slowly eroding it. Persist. Just like guerillas before you.

Key Philosophical Takeaways

Privacy will have to be fought for if it’s to become a human right in the eyes of the West and its tyrants. Rights are not some natural resource you find in a well, they are earned.

"Rights" can be defined as that which society refuses to tolerate. A society that refuses nothing has no rights... and deserves it.

Please internalize this: DeFi disintermediates the state and corporations out of financial infrastructure by design, it’s literally the whole point of this. They are right to fear and hate crypto.

This battle must be understood as game theory, not legal theory. Boobsie Doobsie vs Calvin Coolidge jurisprudence will not save you. The Wooden Canoe Act of 1912, made before computers and abstracted to stablecoins, will not protect us.

This is why the relationship between the US and DeFi is irreconcilable. It doesn’t matter who’s in office. A hegemon will never embrace technology fundamentally designed to decrement its soft power; which is what control of financial infrastructure represents, and what DeFi takes away.

What to Look Forward to in the 5th Generation…

In 4th-gen, the DeFi community is finally disabused of the idea the state will embrace its disintermediation with money and control of financial infrastructure. The US fought wars to win its highly coveted soft power; it will require another one to take it away. Wars do not happen in court rooms. The petrodollar sends its regards.

In Part Three I’ll review 5th-generation warfare and extrapolate where both 5th-gen business and 5th-gen DeFi are headed from a tactical and ideological standpoint. 5th-gen business has not yet arrived, so you’ll get business predictions as well as crypto ones.

The future is here, it’s just not evenly distributed.

Please share with others and subscribe (both are free).

Follow at @BackTheBunny

Excellent article as usual. May I share https://disruptive-horizons.com/p/internet-makes-governments-impotant-bottlenecks as a complement?

Also, how many years do you estimate each stage to take?

You are my favorite… Crypto writer? Financial philosopher? Long-form decentralization enjoyer? Sci-fi grunge artist?

Tough to say exactly what you are; like an open-source developer on trial, you resist classification. Please keep up the good work. Thank you for putting your insights on Substack, for those of us who have more difficulty accessing X and other social media.